A Guide to Understanding Your Commercial Invoice

Commercial invoices might seem complicated, but they’re crucial for smooth shipping and getting through customs. They help keep everything organised, reduce delays, and make sure all the paperwork is in order. Understanding the basics of a commercial invoice makes managing your shipments much easier and more efficient.

Commercial Invoice Made Easy

Guiding You Through the Process of Creating a Compliant Commercial Invoice

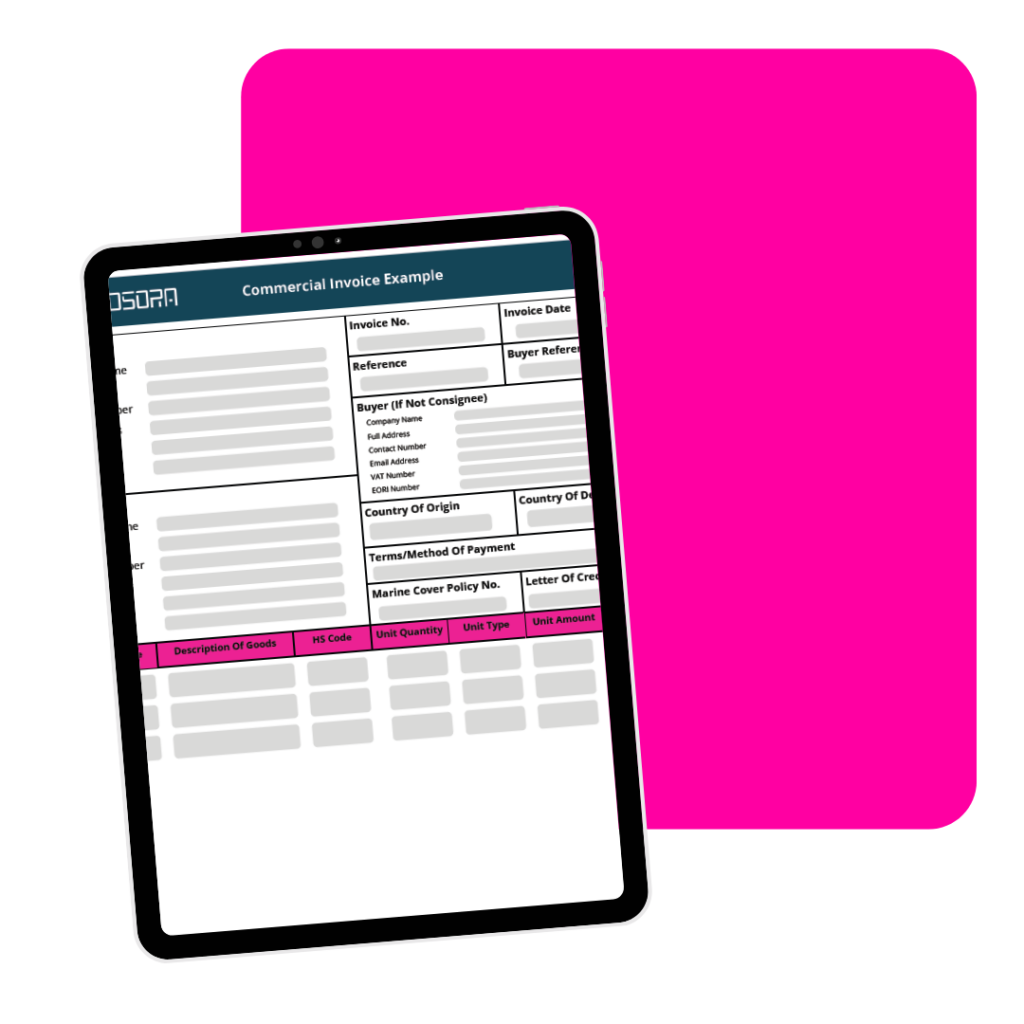

A commercial invoice is a document from the seller to the buyer that details the goods being shipped, their value, and the terms of sale. It’s required for international shipping, as customs uses it to calculate duties and taxes. It also serves as proof of the transaction between the buyer and seller. We are here to help by making sure your commercial invoice is accurate and complete, ensuring it meets all customs requirements. We can guide you on what to include and address any issues that come up, so your shipment clears customs without any hassle.

Commercial Invoice Essentials

What information should be included in a commercial invoice

If something is missed or incorrect on a commercial invoice, it can cause delays with customs, incorrect duties or taxes, and even fines. In some cases, the shipment could be rejected or sent back if key details are missing or wrong. Repeated mistakes can hurt your reputation with customs, shipping companies, and buyers. It can also lead to extra costs for reprocessing paperwork or reshipping goods. On top of that, errors can affect insurance coverage and delay payments. To avoid these problems, it’s important to double check the invoice and reach out to us if you’re unsure about anything.

-

Seller And Buyer Details

-

A Description Of The Goods

-

Payment And Shipping Terms

-

Invoice Number And Date

-

Total Value Of The Goods

-

Country Of Origin And Any Special Certificates

-

Shipping Method And Destination Details

Yes, for any commercial shipment (that involves buying or selling goods), a commercial invoice is required. Even if it’s a gift or a non-sale shipment, a similar document (like a pro forma invoice) is needed.

If the commercial invoice doesn’t match the packing list, it can create confusion and delays with customs. It’s important that both documents match up in terms of product description, quantity, and value to avoid any issues.

A pro forma invoice is often used for things like sample shipments or non-commercial goods (e.g., gifts). However, for a standard commercial transaction, a regular commercial invoice is required for customs clearance.

The value listed should be the actual sale price of the goods, including any extra charges like shipping or insurance if necessary. Customs will assess duties based on this value, so it’s important to be accurate.

If the commercial invoice gets lost or damaged, you should get in touch with your freight forwarder or the seller to issue a replacement. It’s also a good idea to keep a digital copy just in case.